×

All it takes is 2 easy steps

If you're a winner, we will send you $100 Amazon gift card at Dreamforce!

Success in the lending industry rests upon your relationship with your clients. Messaging is one of the best ways to connect and build those relationships. May it be a follow-up message, an appointment reminder, loan status, or documentation confirmation, it can be easily sent to your client via a personalized message.

Messaging for mortgage lending is beneficial in many ways, including:

Here are the top 4 Ways Messaging is Helping Mortgage Lenders Win Over Customers:

Messaging has played a key role in simplifying and reducing processing time and paperwork. Today, messaging is the replacement for paperwork and even emails. Sending reminders, status checks, payment reminders, approvals, etc. can be done through personalized messages. Your clients will appreciate the simplicity of doing business with messaging.

Research shows that 66% of adult children leave their parents’ financial advisor because they can’t connect with them. This applies across all financial sectors, and mortgage lending is definitely not immune. Messaging can help lenders easily create a personal connection with their clients, which will be the best way to also get referrals. Lenders can send relevant information to their clients with insights and tips that are applicable to their specific situation.

Example: How did Upstart win over Customers with Messaging?

Upstart, a lending platform, used messaging to retain hundreds of customers in just six months.

Upstart was having difficulty in keeping loan applicants engaged and active long enough for loans to get funded. They rolled out loan status updates via messaging and saw huge improvements in retention.

This example shows how effectively you can win over your clients through customized, personalized, and automated messages.

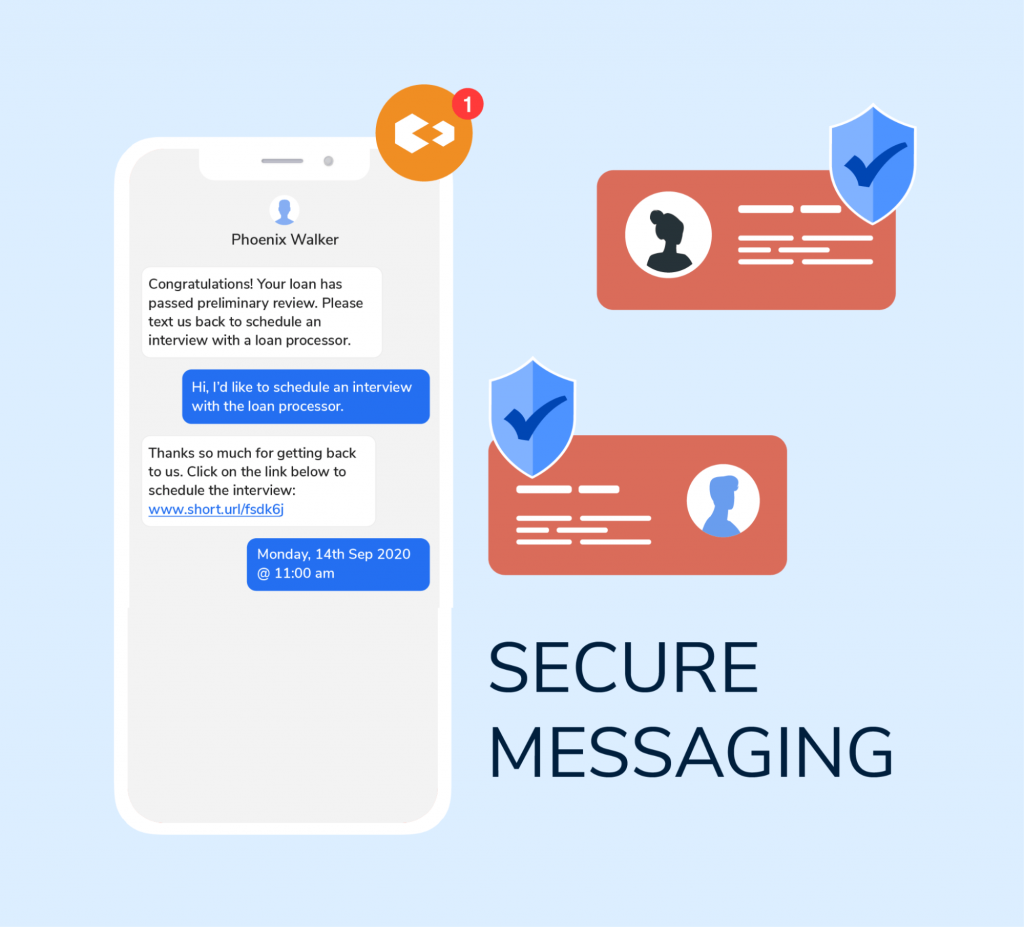

Your clients want peace of mind knowing that their information is secure. Messaging is a newer way of engaging with lenders, so you need to make very clear how you are ensuring their security. With the right messaging platform, you can be ensured about data privacy and regulatory compliance while managing client expectations.

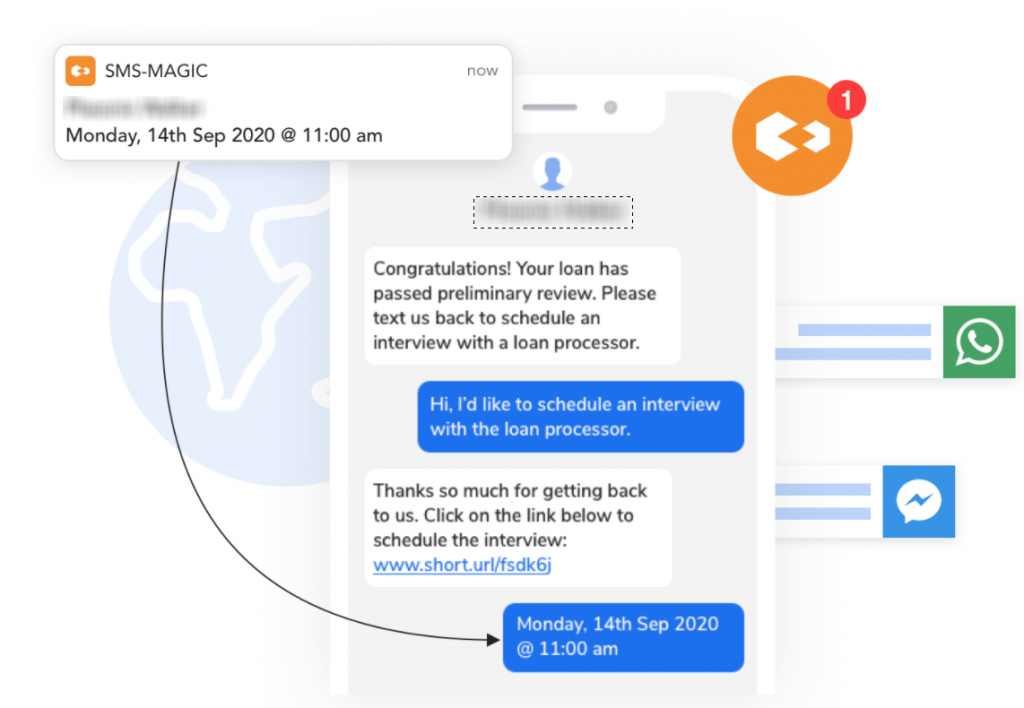

Responding to your clients quickly will have a big impact on satisfaction and retention. The SMS-Magic Mobile App allows our customers to always respond in a timely manner, no matter where they are. In lending, you’ll likely be getting questions at odd hours of the day, so responding on the go can help ease the need to be tied to a desk or laptop.

Conversational messaging will improve engagement and help you build better relationships with your clients. If you haven’t yet adopted business text messaging for your team and want to learn more, schedule a demo, and we would be happy to share our expertise with you, answer questions and show you what text messaging can do for your firm.

Stay updated on business text messaging

Text MAGIC for Demo to

USA: 36343

AUS: (61)409564682

UK & ROW: +44 7860017509

Email: care@sms-magic.com